|

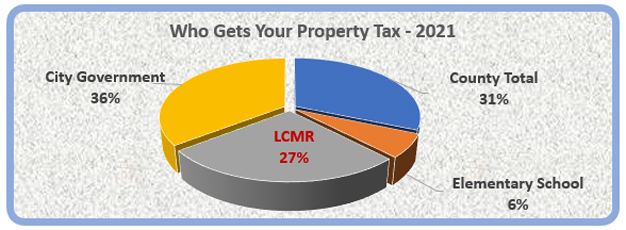

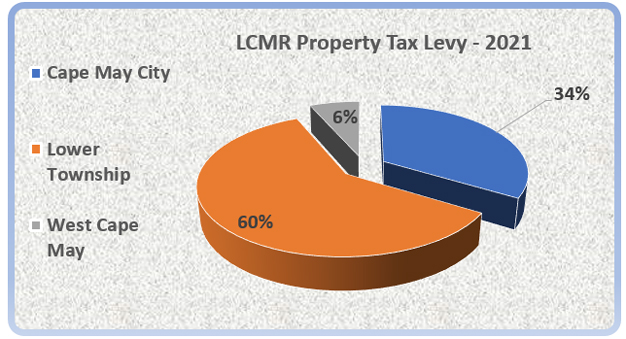

Taxation Update:

For the coming fiscal year, $29,775,757

will be extracted from the property owners

of Cape May City by four taxing entities.

While there will be no tax rate increase

for Cape May City Municipal Services, our

payment to the Lower Cape May Regional

School District (LCMR) will expand from

$7,088,242 in 2020 to $7,962,907 (an

increase of 12.3%) and will account for 27%

of our property tax bill.

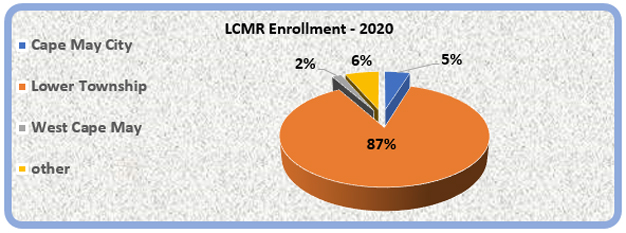

What do we get for $7.9 million? LCMR

enrollment for 2020 was 1,258. Of those

numbers, 60 students are residents of Cape

May, or 4.8% of

the enrollment.

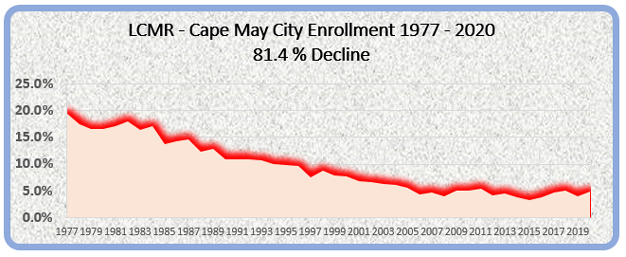

There has been a steady decline in the

number of Cape May residents attending LCMR

since 1977 when Cape May City accounted for

20% of the total enrollment.

Since then, Cape May's share of the total

enrollment at LCMR has fallen by 81.4% while

the total LCMR enrollment is down by about

24%

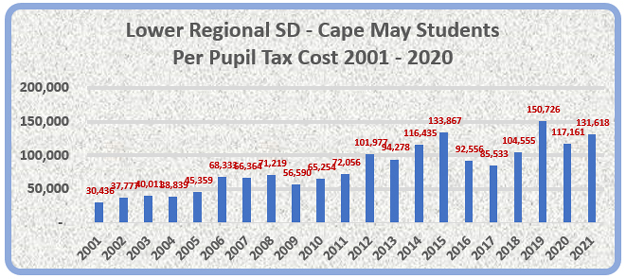

The Cape May City taxpayers' contribution

of $7.9 million for our 60 residents amounts

to a per/pupil tax cost of

$131,618. And, as

LCMR budgets continue to rise while

enrollment continues to shrink, this

per/pupil cost will steadily rise.

Conversely, Lower Township pays a per/pupil

tax cost of $12,915 for its 1,094

residents who attend LCMR.

A Brief History:

The communities of Cape May, Lower

Township and West Cape May agreed by

referendum to form a regional school

district in 1956 and further agreed that a

taxation levy to fund the operation of the

district be apportioned based only on

district enrollment.

In 1975, the New Jersey State Legislature

revised school funding laws to require that

all existing regional school tax levies be

based solely on the equalized value of real

estate, thus eviscerating the content and

intent of the referendum creating the LCMR

district. This action proved a windfall for

Lower Township and West Cape May as Cape May

City property values became a cash cow to

annually subsidize the educational cost for

the residents of their partners in the

regional district. That windfall continues

again this year.

Curiously, the legislature did not alter

the membership of the Regional School Board.

Seats on the Board continue to be allocated

by enrollment percentages. So, Cape May

continues to have one seat on the

nine-member board even though Cape May

provides 34% of the tax revenue to support

the district costs.

In 1993, the legislature acknowledged the

negative impact of its previous action and

changed the law to permit regional school

districts to return to per-pupil funding or

a combination of per-pupil and equalized

property value funding only if voters in

each community served by the regional school

district approved the change.

Repeated attempts to apply that law to

the inequities of the LCMR taxation model

have all failed.

Several court decisions involving

districts with similar circumstances have

focused on the inequities of the statutorily

prescribed fund options and have directed

several Commissioners of Education to review

all such district funding models. No

Commissioner has done this to date.

In December 2003, the LCMR school board

voted 6-2 against a resolution from Cape May

asking to change the funding formula to one

based on 60 percent from property value and

40 percent based on the number of students

sent to the district.

In 2004 the LCMR school board also voted

against placing a referendum on the 2004

school board election ballot to change the

regional school funding formula.

In 2005, the City of Cape May mounted an

aggressive effort to modify or eliminate the

"grossly disproportionate tax burden"

inherent in the LCMR funding model,

retaining educator/consultants and attorneys

to address the issue.

From 2012 to 2015 Cape May City Council,

and former Deputy Mayor Jack Wichterman led

a careful and costly legal effort to fix

this problem.

In 2014 the State Department of Education

denied Cape May's petition to withdraw from

the LCMR.

Also, in 2014 the member districts of the

LCMR defeated a referendum to modify the

taxation model, largely due to the voters of

Lower Township opposing any change in their

access to the cash cow of Cape May property

values.

Over time our District State and Federal

legislators have been urged to address and

resolve this issue. They have been

unwilling or unable to do so, apparently

favoring voter turnout over tax equity.

From 2000 to the present, the CMTPA has

taken an active role in keeping this issue

at the forefront of public concern.

What Hasn't Been Tried?

It has become clear over time that there

is little interest among our partner

communities in the LCMR in resolving the

inequity of the current taxation

apportionment. Periodic property value

reassessments do adjust values and the tax

levy for short periods of time, but the

escalation of cost and the declining

enrollment from Cape May will force the

inequity to become more severe.

Neither Is help likely from County or

State education officials who have shown

little interest beyond preserving the status

quo. Litigation to date has been

fruitless.

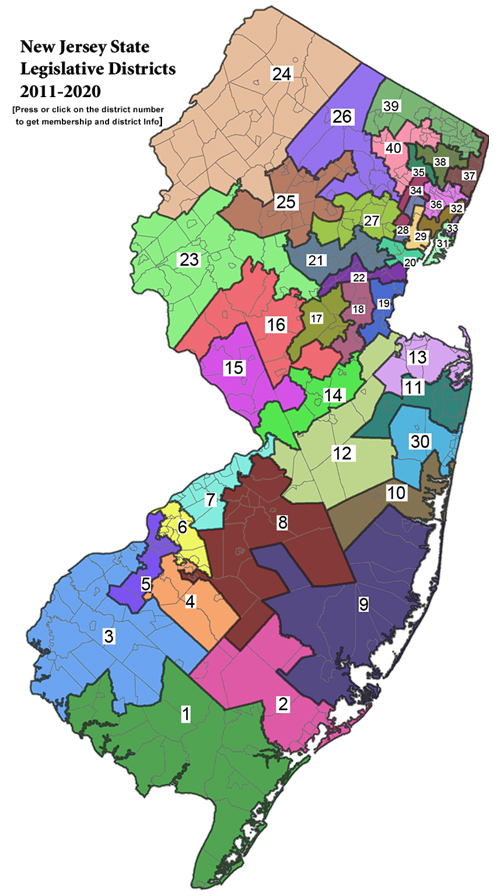

What is clear is that legislation

to correct this flawed statute is perhaps

the only viable option left for Cape May.

Cape May is a unique place in that the

significant majority of property taxpayers

live somewhere other than Cape May, in

places across 33 states and 2 foreign

countries.

However, of the 3,980 taxable

properties in Cape May, most owners (53%)

live somewhere in New Jersey.

There are 40 Legislative Districts in NJ

each with 1 senator and 2 assembly members.

Across the State, Cape May taxpayers are

part of the constituencies of these 120

elected officials. Perhaps it is time

these elected officials become informed

about the inequity affecting their

constituents under current statutes. We pay

taxes in Cape May, but we live all over New

Jersey.

At a time when the Governor and the

Legislature are ramping up interest in new

legislation to regionalize schools and

municipal services, perhaps they need to be

educated on how one of these current

regional schemes works against the interests

of some of its members. And how to avoid

these inequities going forward.

CMTPA urges all Cape May property

taxpayers to reach out to their elected

legislative representatives wherever they

live across New Jersey. Help them understand

the impact this flawed regional taxation

formula is having on one their constituents

and seek their support for legislation to

correct it.

You will find you

legislators' contact information here:

http://www.njleg.state.nj.us/members/roster.asp

Not much has worked to resolve this issue

so far. We think this I worth a try.

Let us know if there is anything we can do

to help you. We have your back.

|